Image courtesy of SoFi

In 2015, I was looking to leave the “traditional” big [evil] banks that take from you more than they give. A bank should store your money, be a financial resource, help your financial situation, not steal money from your account. Overdraft fees should be illegal. Minimum balances are extortion. And while they are taking days to get your money from one place to another, they are making money in interest all of which you never see.

SoFi has become my new age, technology bank of choice. With a superb app, great website, 1.00% APY on checking accounts, point system, fun financial incentive to help you practice mindful and successful finances, 2% cash back credit card, low(ish) interest rate loans, students loan refinancing, vaults, now fees, and so much more, I took 90% of my money from the big ugly bank I’ve dealt with so long and made the switch.

It has been fun, successful, and empowering to have a bank that is interested in my success because if I’m successful, so will they be as a bank. While I would use the word ‘innovative,’ I actually don’t think they are. That might read like a contradiction or a criticism but they are just proceeding the way a bank should operate rather than the way most banks and their greed have lead them to operate.

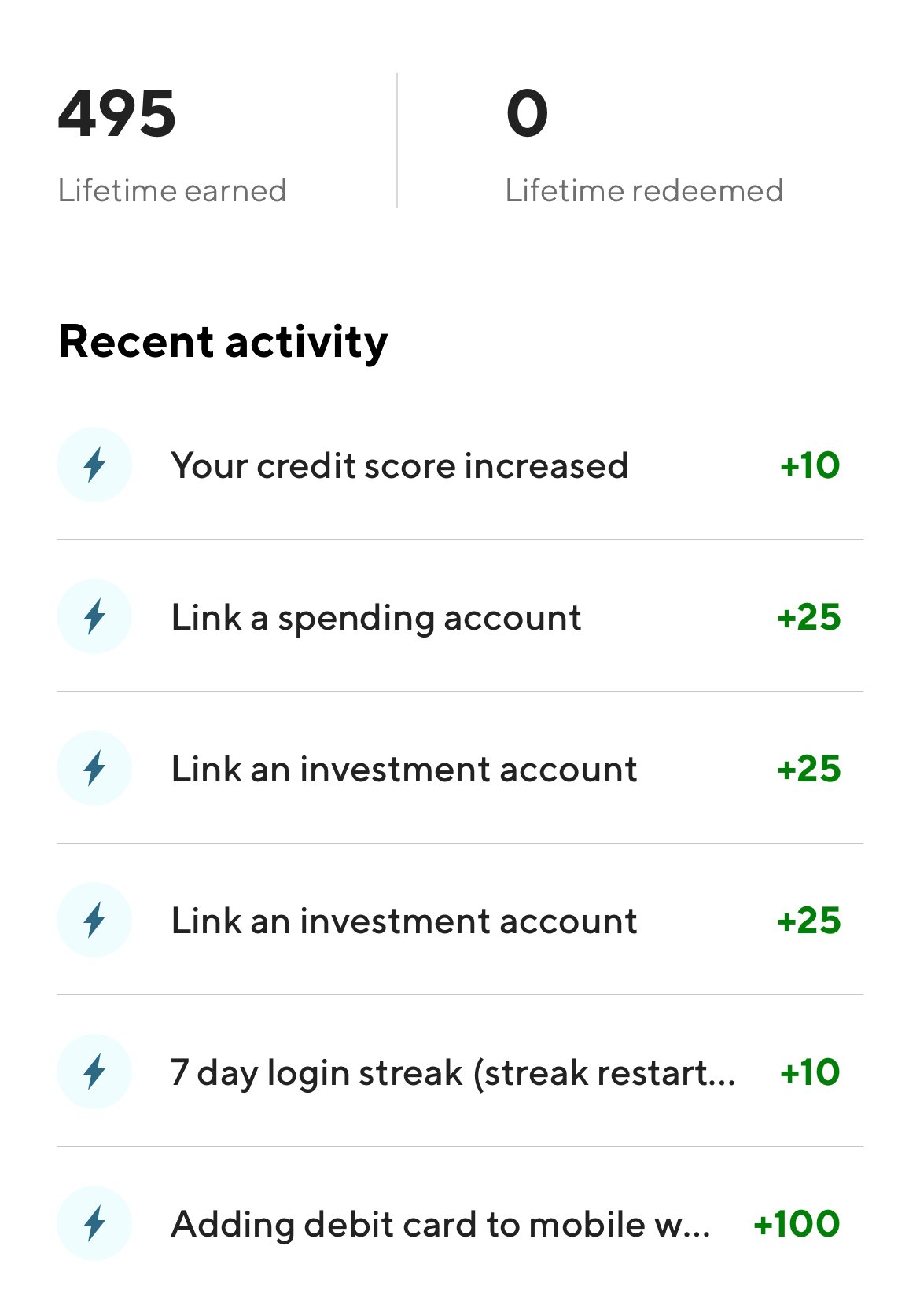

For example, one gets points for financial success. When there is a rise in one’s credit score, 10 points are awarded. The same for making investments, saving money, connecting other financial accounts, or simple login streaks to keep a close eye on finances. These points can be redeems for future investments or cash them out for $0.01 per point.

I would wholly recommend checking out SoFi for your banking needs. Currently, there is a nice little referral link from me below but if you deposit $1000 into a new Money account (checking/savings hybrid with a minimum of .25% APY—33x the national average) you receive $100.

I have been so impressed with them as a company and bank that I also own stock (SOFI). I put my money where my mouth and wallet are.

I highly recommend SoFi—and those are word Adrian Galli has never put together in the same sentence.

Rewards

Points for account activity

2% Cash back on credit card purchases

1.00% APY on Money accounts with direct deposit