Image courtesy of John Cameron

@johncameron

Adrian’s Life Rule #28: Don't think "outside box," think "there is no box."

There is an idea that the “poor mindset” is a poor mindset. To be clear, a poor mindset is not that of having a lower monetary stature, though that could also be the case, but also ‘poor’ as in deficient.

When one says ‘I can’t afford that,’ one’s mind immediately rejects any possibilities of actually realizing strategies to achieve one’s goal. A rich mindset is ‘how can I’ rather than ‘I can’t.’

For example, “I can’t afford to buy aniPad.” In that one moment, it is the end of the whole idea. But what if you changed that to, “how can I afford that iPad?” You’ve opened yourself up to a whole world of possibilities. What other resources do you have? Can you sell something? What about a skill you could monetize? Perhaps it would be ill-advised to buy it today but what if you made a plan to buy that iPad in a month?

Now you have a goal and strategy in mind rather than a hard stop. If the iPad you want is going to cost you $600, you could put in your mind that you need $75 saved every week for the next two months. Next question, ‘how can I save that every week?” Your strategy could look at the last few months of spending and see at that which you did not need to spend. Perhaps you went out two or three times a week. Change that to only Friday. And rather than going to a bar after dinner with your friends, invite them back to your place to enjoy some homemade cocktails. You might have just save that $75.

The whole scenario might open you up to buying it today. Perhaps you buy that iPad with your American Express knowing that when the bill is due, you will have now save $600. Credit cards are a real value if you use them appropriately—the interest will become a chasm you will fall into if you carry too high a balance. Pay it off at the end of the month or as quickly as possible.

While one might still think, “I wish I had more money,” your mindset overall changed from ‘can’t’ to ‘achieve.’ The size of your goal is also irrelevant—this simple example of buying an iPad can be scaled to anything. The timeline, money, and challenges may be different but, as we say in Quantum Physics, there is no such thing is impossible, only improbable. Consider the idea of owning a $10,000,000 yacht. Today it may seem highly improbably but until you build a strategy, it will become more and more improbable. While it may take ten years, a new job, and living extremely frugally, it is not impossible.

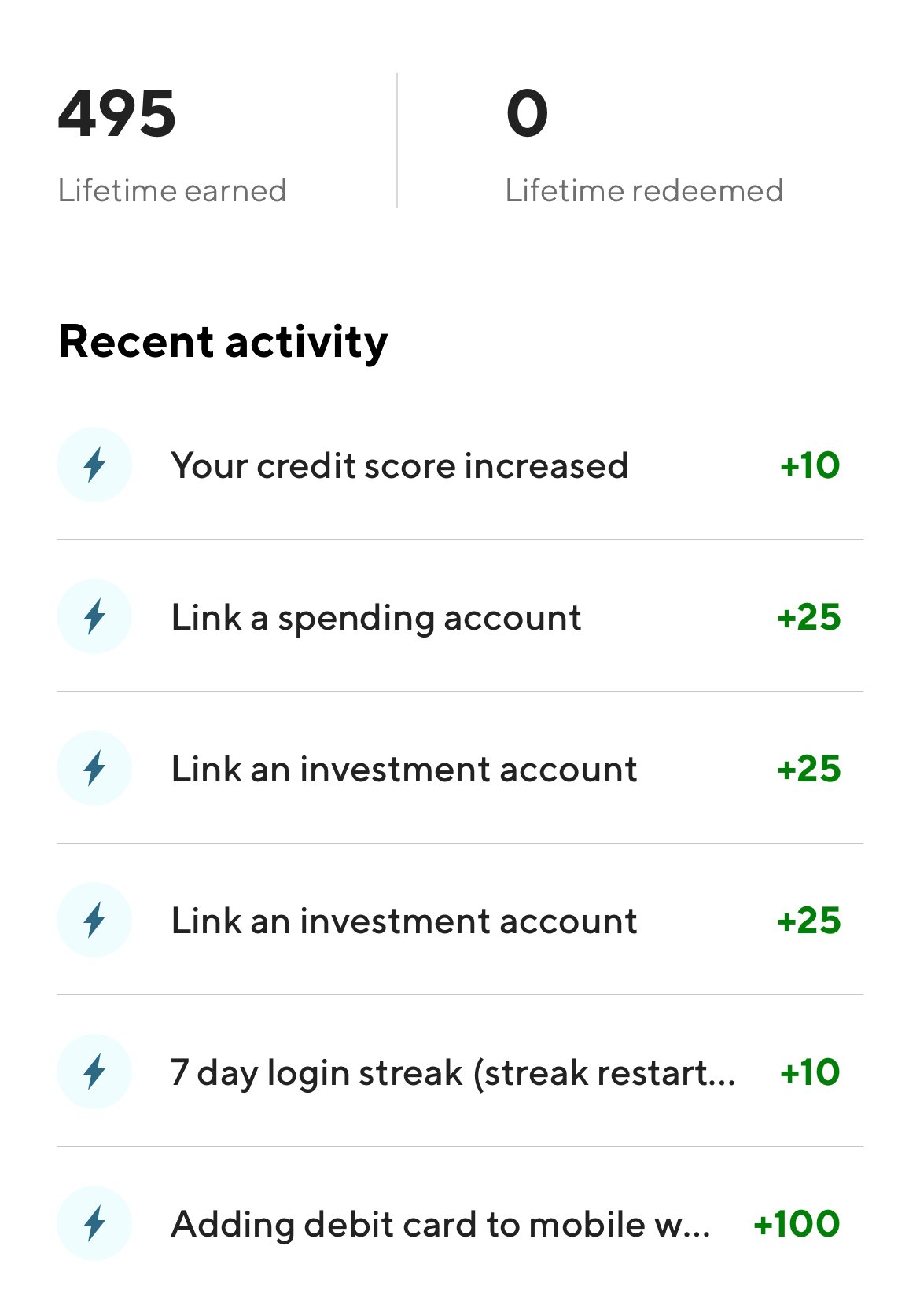

Some steps one could also take is using financial tools. I’ve discussed Acorns and SoFi before and one tool that SoFi has is what’s known as a Vault. These are “mini-savings” accounts that one can put money into regularly. It can be automatic like $10 a week, or randomly when you have a little extra money. Not only does it have a purpose, it also has a schedule. Set a date you want to achieve the goal and SoFi will calculate how much you need to save to meet your goal. Vaults are also part of your SoFi Money account and thus accumulate interest.

What is a goal you want to achieve? What actions can you take to achieve that goal? Share your thoughts and ideas in the comments.

P.S. Happy Pi Day!