Saving money can be challenging. There is so much cool stuff to buy, vacations to take... bills to pay. I have a 401k, a savings account, and a change jar. I feel pretty good about my savings overall but years ago I wanted to have something a little more automatic and silent.

Great thing about a 401k, you can’t really touch the money until you retire. Bad thing about savings, you can pull from it whenever. Funny thing about the change jar, I rarely use cash so if there is ten dollars in that jar, it is a lot.

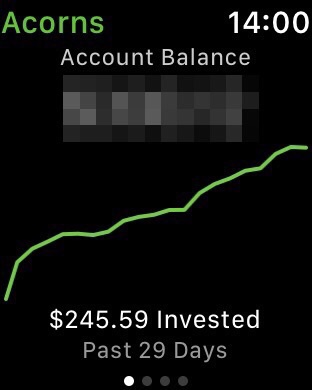

When Apple Watch launches in 2015, a lot of developers were showcasing their skill and ideas in what they could do making apps for watchOS. One that caught my eye was a very stylish app named Acorns—a digital version of a change jar but also a lot more.

The Basics:

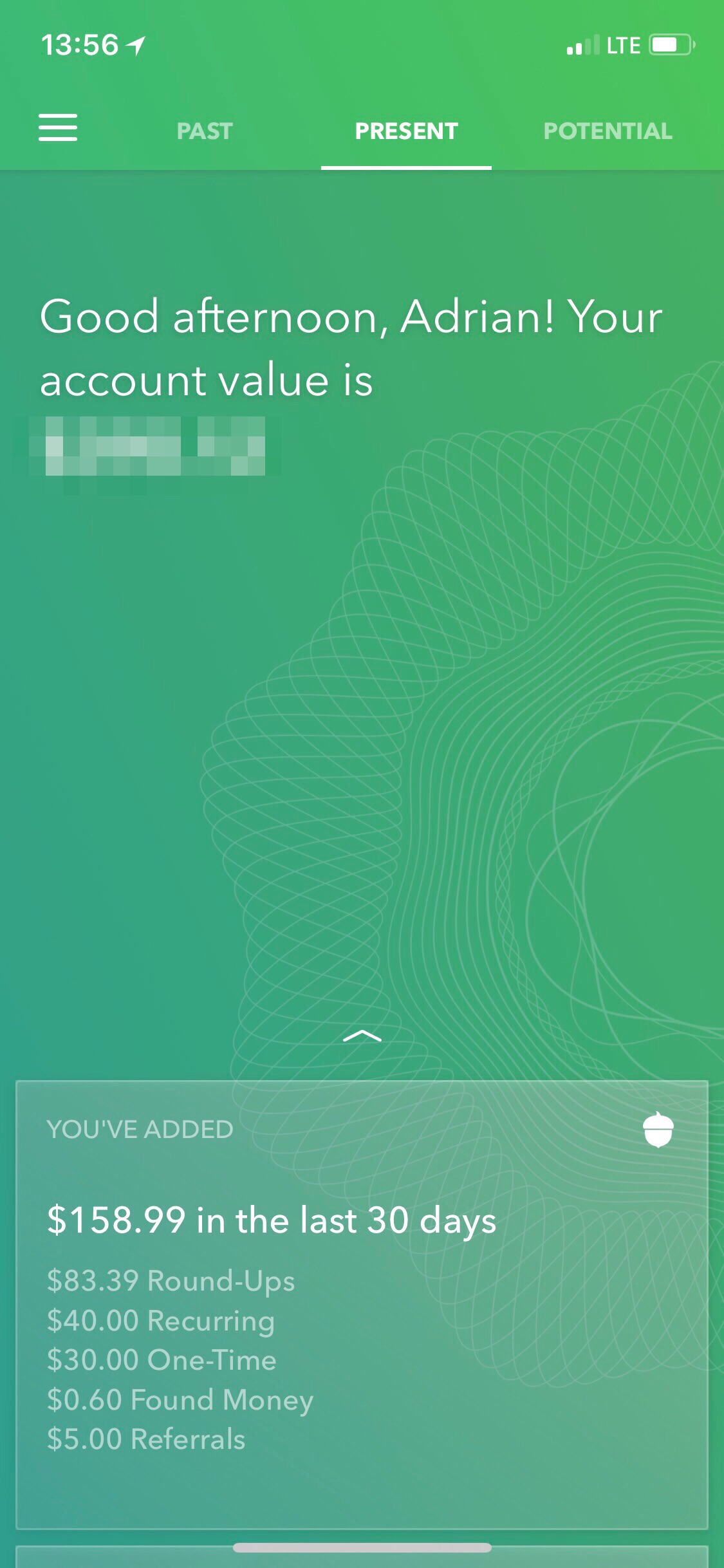

Opening an account with Acorns, you link any debit or credit card(s) you’d like. Ever purchase you make using the registered cards will rounded up to the next dollar and that money is then deposited into you Acorn account. They call them 'Round-Ups.'

Like a change jar or piggy bank, that change adds up pretty quickly. You need not do anything other than pay for things as you would normally.

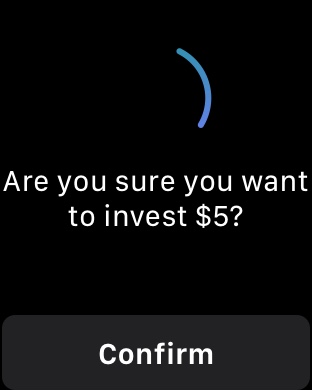

After you hit a threshold, five dollars is the default, that money comes out of your checking account and is deposited into the your Acorns market.

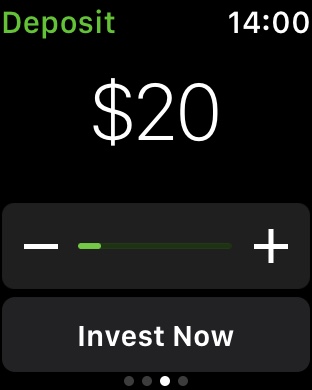

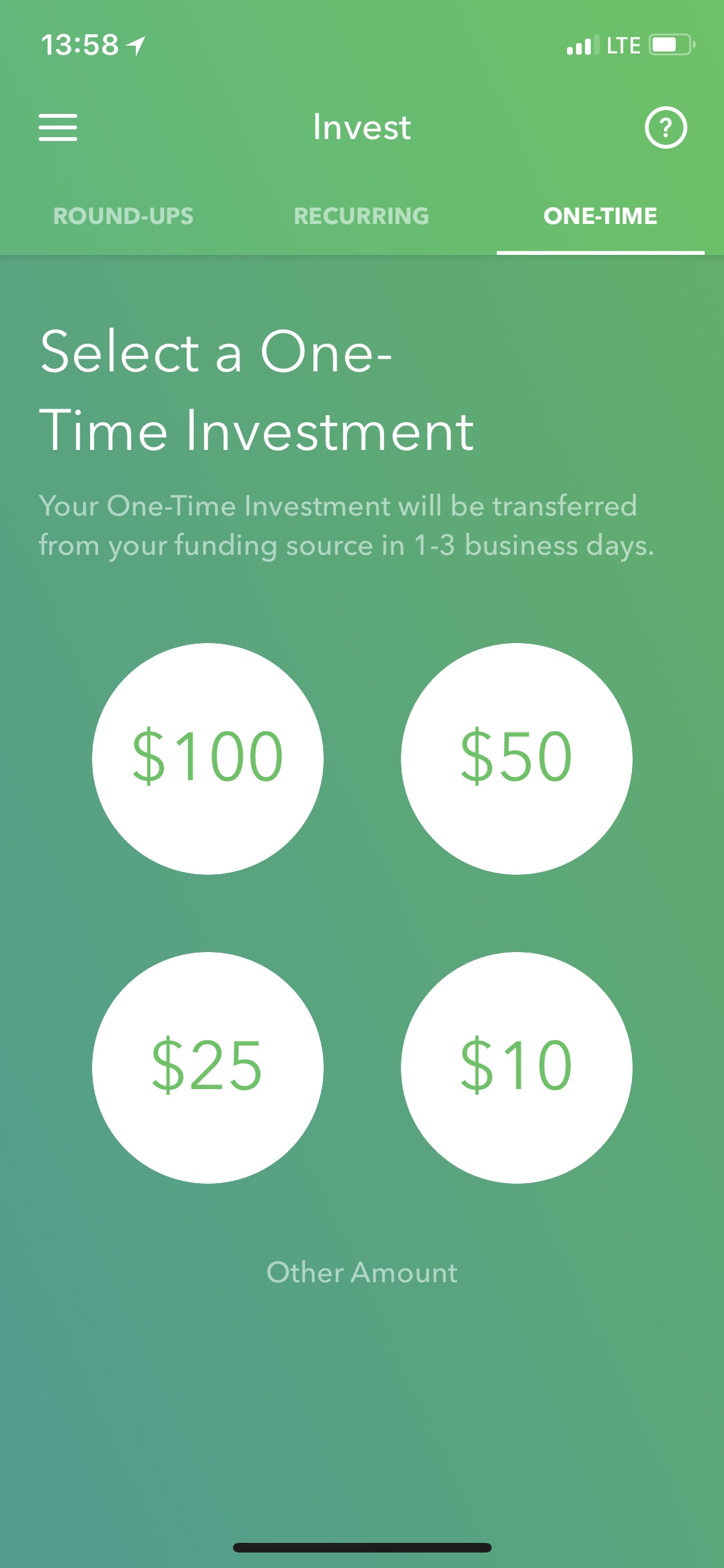

Additionally, you can setup automatic deposits every week or month. You can open up the app on iPhone or Apple Watch and deposit a specific amount anytime. The Apple Watch version is exactly that an watchOS app should be—quick, simple, at-a-glance, functions.

The best part is that you’ll have the opportunity to pull money anytime, should you need it, without any penalty. I’m not an investment advisor but I’d vote on keeping it in the account longer than shorter.

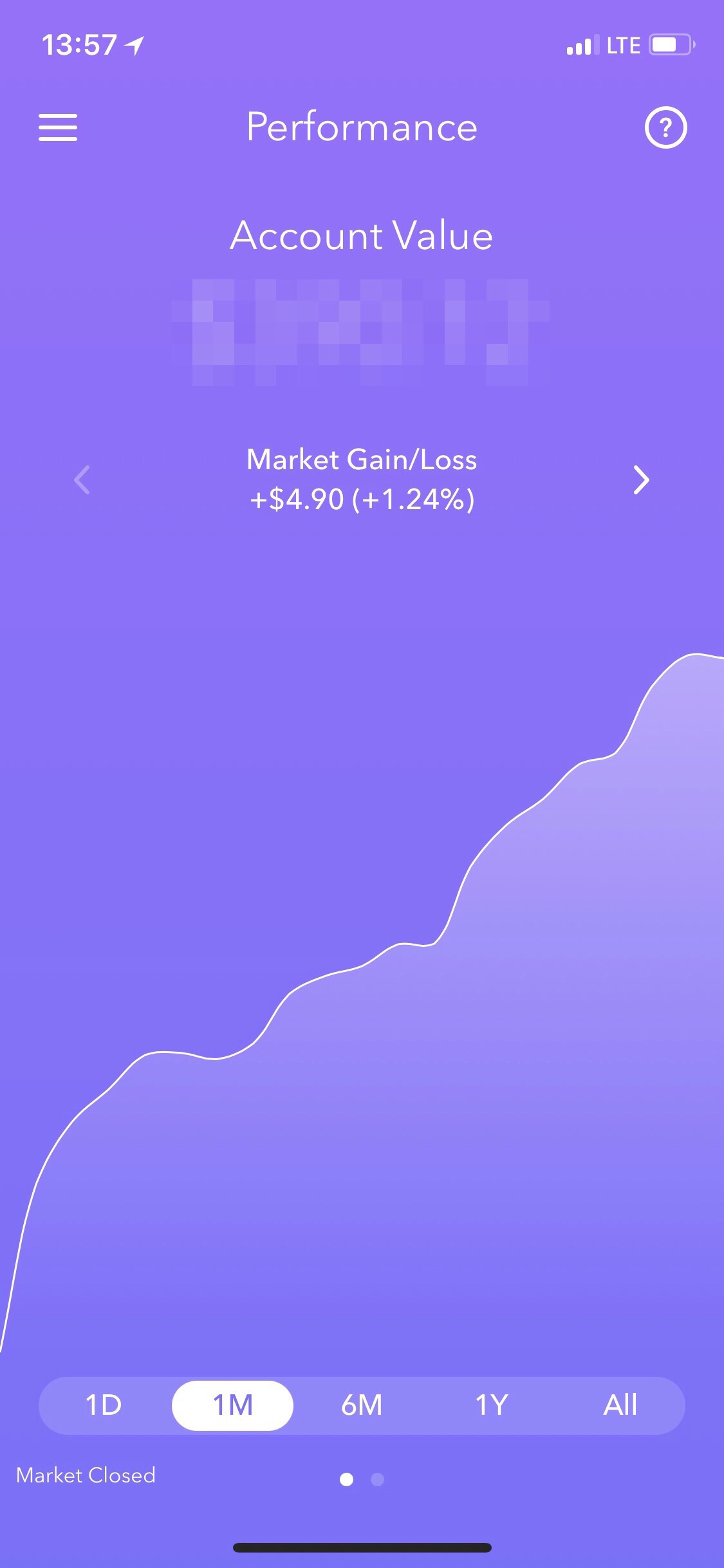

When setting up the account, it will ask you how to manager the investments. Since this is a secondary investment opportunity for me, I have it set to aggressively invest the money. I don’t have tens of thousands in Acorns so it doesn’t bother me to see it fluctuate but over all it has made gains.

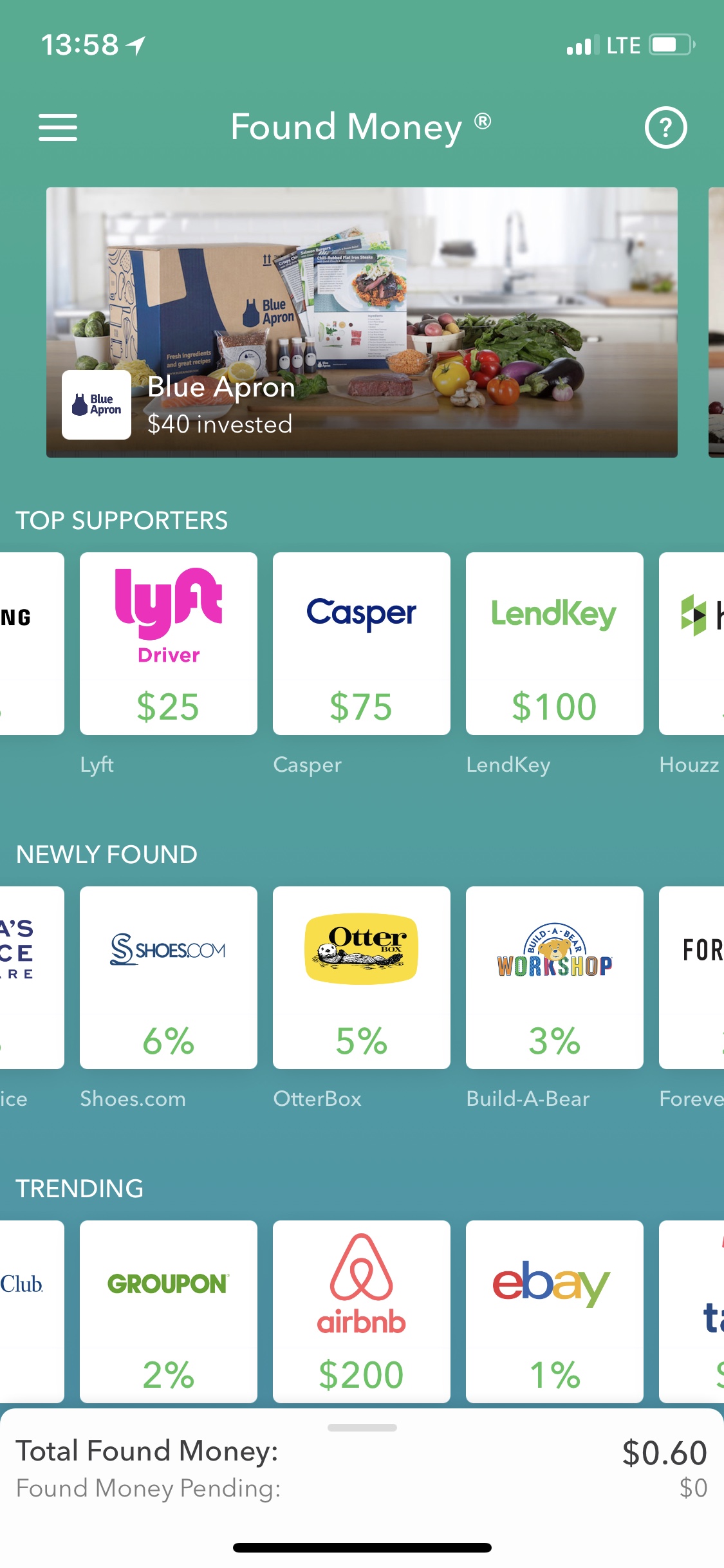

There are some other functions that are fun and helpful. Found Money is a feature linked to some of the biggest online retailers and brands like eBay, New Balance, Nike, Walgreens, and Apple.

When you purchase things from those companies through the Acorns app, a specific value or percentage of your purchase is gifted to your Acorns account. If you buy some Nike shoes, for example, the investment is currently 5% of you purchase. Not bad.

Over the years I’ve used it, I’ve literally saved months of rent worth of money. Because it is not something I access frequently, I’m not tempted to spend the money. Being a beautiful app, fun, easy to use, and nicely designed, Acorns adds a little incentive to saving money.

It ranks in as one of my favorite apps simply because of how it works and its design but it also is a favorite service. I definitely recommend it. Make it your digital piggy bank and save for a vacation, your future, or just have some backup money for an emergency.

Download and everyone who signs up gets $5.

Price: Free