If you know the stock market, you can make some serious bank. But for many of us, it is challenging because we DON’T know the market. Where does one start? What is a good stock? How much money should be invested? These questions are endless and, I’d wager, prevent people from taking the first steps into the market. After all, only a fool would bet what little they have only to lose it all.

Public is a social media app for stocks, crypto, and ETFs, that I’ve become quite fond if. On the surface, it is for buying/selling stocks but a little deeper one will find a community of people—beginners and pros alike.

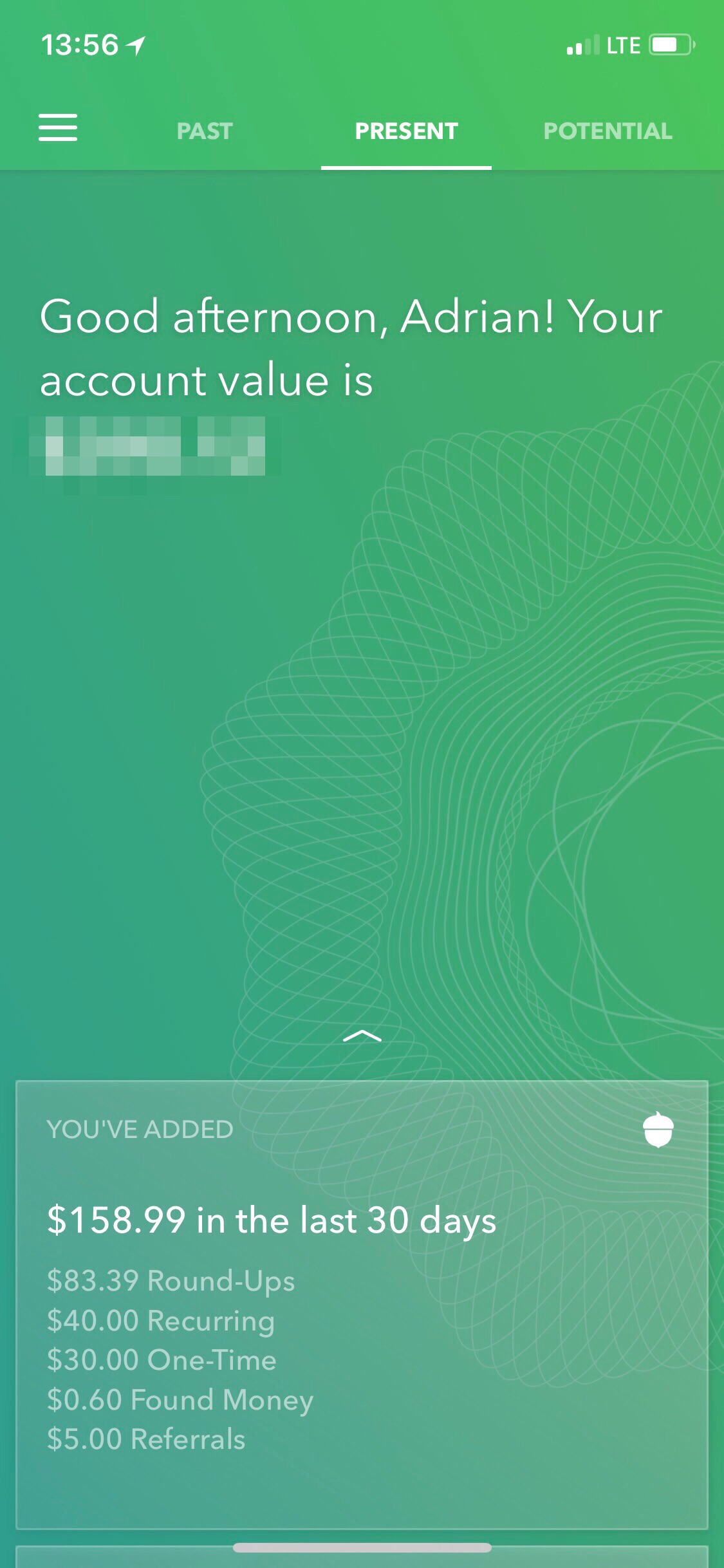

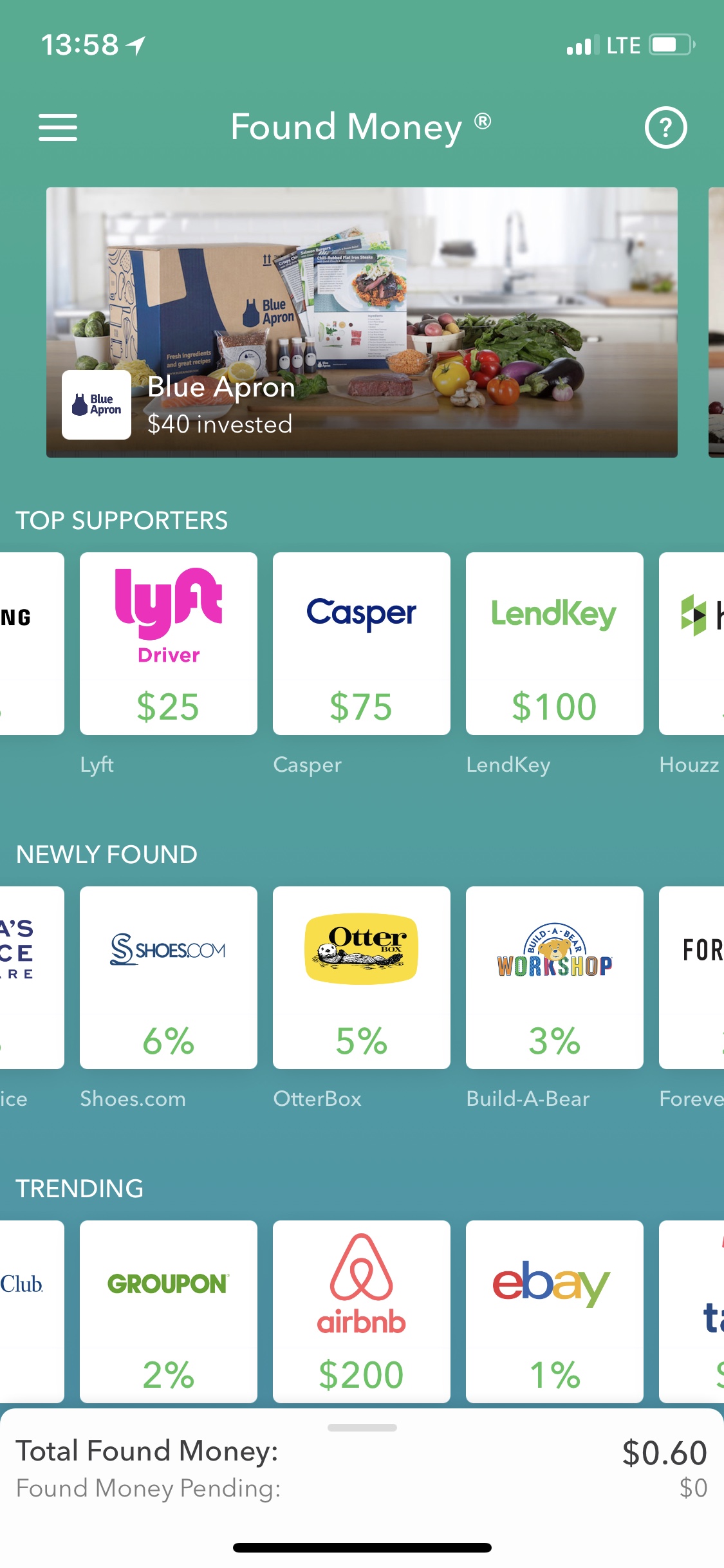

Like a Twitter for investing, one can follow other investors, they can follow you back, and you can join groups to discuss things like # cheapstocks which is a personal favorite of mine. As you work your investments, every sell or buy can be posted into a feed, giving both insight to what you and others are investing. See what is hot, what has been most generous in daily gains or see what stocks are dropping (Buy the dip!).

Websites like E*TRADE are very complicated and impossible to navigate. That can be the different between making a lot of money and losing a lot of money. Quick buys and sells are sometimes vital if one day trades (careful!) and an app like Public gives you all the power of a general investing platform with the simplicity of a social media app.

Once the setup of an account is complete, linking a debit card or bank account allows for easy cashing out or transferring money in for investing. This money is available to invest immediately and all the traditional functions are available like buy market price, limits, and so forth.

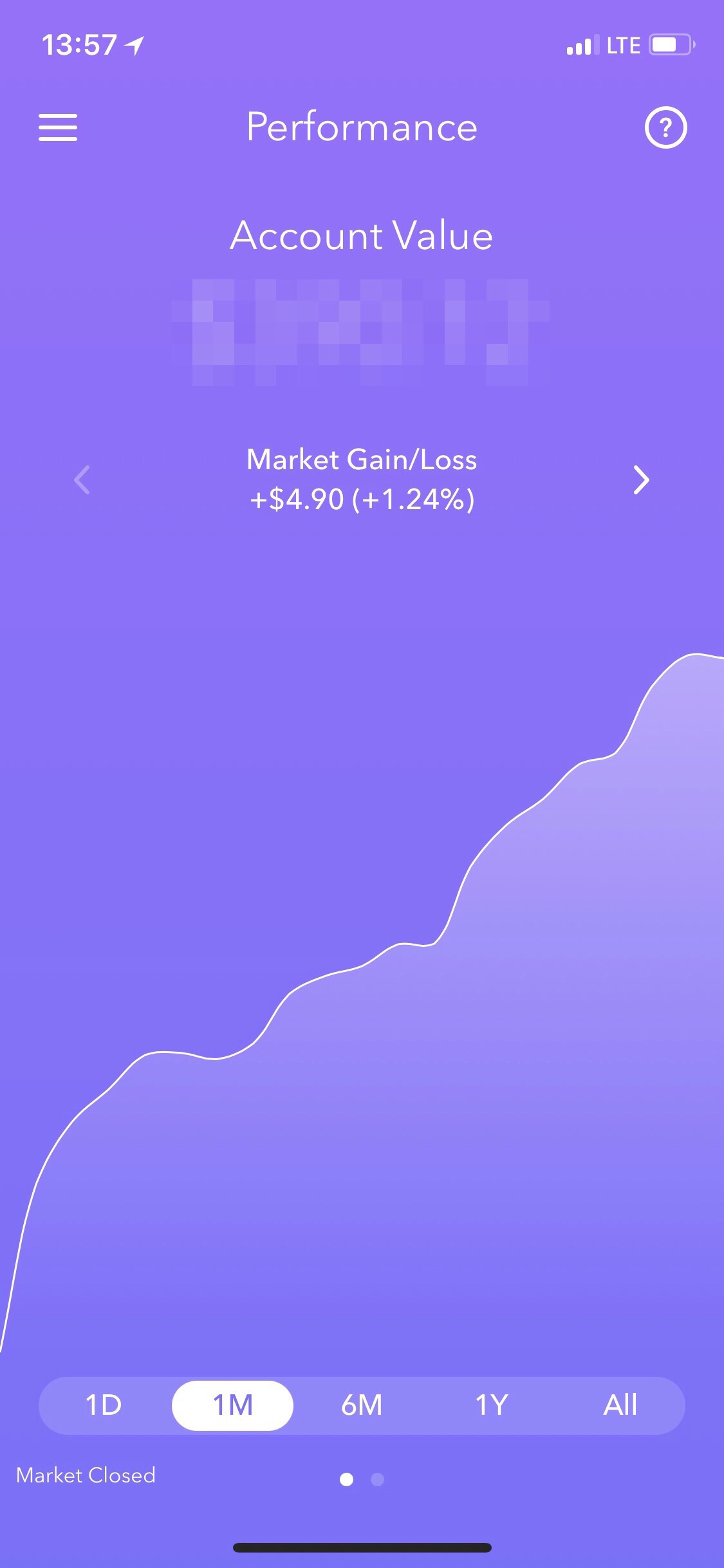

I’m not a financial advisor so I probably need to preface this by saying, this article is for demonstration and entertainment purposes only. I’ve been successful overall in making a few dollars using Public and generally think it is a good way to get into the marketplace. You can start with a single dollar if you want and get your feet wet. To help, my referral link below will get you free stock. Free money!

And if you’re curious about what stocks invest in, feel free to follow me on Public! I mostly dabble in penny stocks on Public—speed is very important to making money as penny stocks can be very volatile so Public is a great platform for me.

Check out Public and start investing.